how much tax is taken out of my paycheck in san francisco

The 2018 Payroll Expense Tax rate is 0380 percent. GOBankingRates found the total income taxes paid total tax burden and how much was taken out of a bi-weekly paycheck for each state.

How Much Is A 160 000 Year Salary After Taxes In California Quora

So if you elect to save 10 of your income in your companys 401 k plan 10 of your pay will come out of each paycheck.

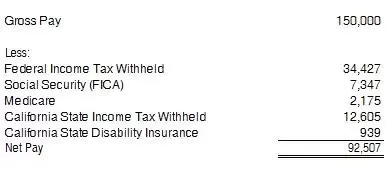

. You can leave your heart in San Francisco and when you work anywhere in California you leave a big chunk of your pay behind to taxes. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Switch to California hourly calculator. See How Easy It Is. California Salary Paycheck Calculator.

The amount of tax each employee owes varies based on their salary household income filing status tax credits. State income tax swallows 676 of your 100K pay in the Golden State. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

A paycheck calculator lets you know what amount of money will be reserved for taxes and what amount you will actually receive. However making pre-tax contributions will also decrease the. Property taxes also known as real estate taxes real property taxes or secured property taxes are calculated by taking the assessed value of the property and multiplying it by the current tax rate as of today the current rate is approximately.

Use tab to go to the next focusable element. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. Youll need to withhold this tax from your employees paychecks based on information from Form W-4.

Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. I am often asked about SF property taxes how they are calculated and when they are due. If you increase your contributions your paychecks will get smaller.

Call San Francisco IHSS Provider Help Desk at 415-557-6200 or State IHSS Service Desk at 866-376-7066. However each state specifies its own tax rates. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Your average tax rate is 220 and your marginal tax rate is 397. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The payroll taxes taken from your paycheck include Social Security and Medicare taxes also called FICA Federal Insurance Contributions Act taxes.

We depend on word of mouth to help us grow and keep the US Tax Calculator free to use. Below is a state-by-state map showing rates for taxes including supplemental taxes and workers compensation. Calculates take home pay based on up to six different pay rates that you enter.

The Medicare tax rate is 145. We hope you found this salary example useful and now feel your can work out taxes on 95k salary if you did it would be great if you could share it and let others know about iCalculator. FICA taxes are commonly called the payroll tax.

For instance an increase of 100 in your salary will be taxed 3965 hence your net pay will only increase by 6035. Your take-home from a 100000 salary after federal and state taxes is just 68332. Learn about the Citys property taxes.

The federal government determines the percentages employees will pay for payroll taxes. Generally paycheck calculators will show the take-home salary for salaried and hourly workers. Take Home Pay for 2022.

The current tax rate is 6 though most employers qualify for credits that can reduce their rate to 06. The 2019 rate is 60 but there are credits that can reduce your rate to 06. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

You withhold it from their paychecks based on their withholding selection in their W-4 form. The taxes that are withheld from employee wages are. Nonresidents who work in San Francisco also pay a local income tax of 150 the same.

Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. The Social Security tax provides retirement and disability benefits for employees and their. FUTA federal unemployment tax.

Things such as marital status. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Take Home Pay for 2022.

July 10 2020 Patrick Lowell. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. FICA taxes consist of Social Security and Medicare taxes.

The Payroll Expense Tax will not be phased out in 2018 as originally planned due to less-than-expected revenue from the Gross Receipts Tax. We depend on word of mouth to help us grow and keep the US Tax Calculator free to use. This calculator determines the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amount.

Both employers and employees are responsible for payroll taxes. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. 27 rows When calculating your take-home pay the first thing to come out of your earnings are FICA.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each are set by the IRS. These amounts are paid by both employees and employers. We hope you found this salary example useful and now feel your can work out taxes on 77k salary if you did it would be great if you could share it and let others know about iCalculator.

Starting in 2014 the Payroll Expense Tax was to be phased. However they dont include all taxes related to payroll. Details Background Before 2014 San Francisco imposed a 15 percent payroll tax on businesses operating in the city.

Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer Tax Collector Office. But there are no local income taxes. This refund was generated in the annual tax reconciliation processes of over-collected FICA payroll deductions across the 2018 tax year.

This refund payment does not change your gross pay for 2018. Calculates net pay or take home pay for salaried employees which is wages after withholdings and taxes. They can also help calculate the amount of overtime pay will be paid out directly in your check.

Youll pay this tax on the first 7000 of each employees wages each year.

I Make 120k Year In Bay Area But My Monthly Net Is 5700 What S Wrong Quora

How To Pay Little To No Taxes For The Rest Of Your Life

Here S How Much Money You Take Home From A 75 000 Salary

How To Pay Little To No Taxes For The Rest Of Your Life

California Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset

How To Pay Little To No Taxes For The Rest Of Your Life

7 Ways To Pay Your Rent When You Don T Have The Money How To Raise Money Rent Smart Money

Sweden Fitol Gas Utility Bill Template In Word Format Bill Template Templates Utility Bill

After Tax Salary In San Francisco Ca Comparably

Car Driver Salary Receipt Template Format Excel Template Receipt Template Excel Templates Project Management Templates

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

If You Are Making 140k And You Re Single How Much Do You Take Home After Taxes In California Quora

New Tax Law Take Home Pay Calculator For 75 000 Salary

Different Types Of Payroll Deductions Gusto

What Is A Breakdown For Take Home Pay On A 120 000 Salary Living In San Francisco Quora

Money Orders Are Safer Than Checks For Purchaser And Recipient Since A Money Order Is Prepaid It Can T Bounce Printable Play Money Fake Money Money Order

Another City Is Paying Newcomers To Move There Topeka States In America Best Places To Retire